exxon stock dividends history

XOMs dividend yield history payout ratio proprietary DARS rating much more. Historical dividends when charted graphically can reveal the long-term.

Is It Smart To Buy Exxon Mobil Corporation Nyse Xom Before It Goes Ex Dividend

More Production More Income.

. When picking the best Fidelity funds for dividends savvy investors know to look at the funds 30-day SEC Yield. Returns as of 08312022. You may automatically reinvest all or part of your dividends in additional shares of ExxonMobil stock through the Computershare Investment Plan for ExxonMobil Common Stock.

For US and Canadian Stocks the Overview page includes key statistics on the stocks fundamentals with a link to see more. Average returns for the Exxon Mobil stock have averaged near 14 for nearly every year of its 47-year history including pre-merger years and the company has. The 1 Source For Dividend Investing.

We found five top picks that could be big winners in. Webull offers kinds of Exxon Mobil Corp stock information including NYSEXOM real-time market quotes financial reports professional analyst ratings in-depth charts corporate actions XOM stock news and many more online research tools to help you make informed decisions. Exxon Mobil Corporation XOM dividend summary.

View the latest XOM stock quote and chart on MSN Money. Calculated by average return of all stock recommendations since inception of the Stock Advisor service in February of 2002. Dividend information Purchase shares or reinvest dividends Investment calculator Historic price lookup Stock chart Stock quote Stock split history.

For more information on dividend payment options call. Yield payout growth announce date ex-dividend date payout date and Seeking Alpha Premium dividend score. This is also called the 30-day yield or SEC yield This figure will tell you how much a fund earned during the last calendar month minus expenses.

Climate change Energy Carbon Summary Outlook for Energy Sustainability Report Sustainable water and energy Policy accountability and transparency Corporate governance Risk. Despite Exxon Mobils pledge to return approximately 30 billion via share repurchases and a nearly equivalent amount via dividends in 2022 some analysts highlighted at least one issue with the. Dive deeper with interactive charts and top stories of EXXON MOBIL CORPORATION.

Manchins bill is a potential impetus for XOM stock but lets not ignore another impactful recent event. Exxon Mobil is trading at 15 off its 52-week high of 105. The index screens for multinational household names with a history of increasing dividends for at least 25 years with some of them doing so for more than 40 years.

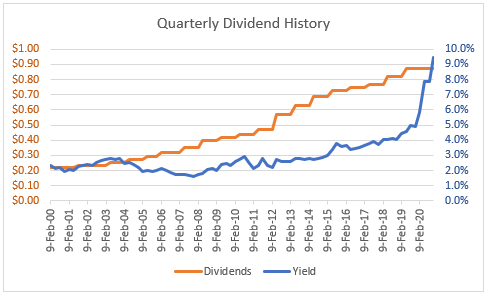

Exxon Chevron post blowout earnings oil majors bet on buybacks Exxon Mobil XOM and Chevron CVX Shares Gain After Q2 Earnings Beat Exxon Mobil XOM Declares 088 Quarterly Dividend. See why I am anticipating a solid 25 total return opportunity from XOM over the next 12 months. XOM Dividend History Chart.

It is computed by multiplying the market price by the number of outstanding shares. Some companies have a history of consistently raising dividends every year even late in market cycles and through previous recessions according to a Monday note from Wolfe Research. 1-800-252-1800 within the US.

Nasdaq Dividend History provides straightforward stocks historical dividends data. Looking at the Exxon Mobil stock split history from start to finish an original position size of 1000 shares would have turned into 32000 today. For example a publicly held.

Dividend payout record can be used to gauge the companys long-term performance when analyzing individual stocks. Find the latest Exxon Mobil Corporation XOM stock quote history news and other vital information to help you with your stock trading and investing. We screened the Value 10 portfolio for the five stocks with the highest dividends.

Capitalization or market value of a stock is simply the market value of all outstanding shares. 3 Best Fidelity Funds for Dividends. Discounted offers are only available to new.

It doesnt translate directly to how much. XOM Stock Dividend History The XOM dividend history graphic shown above is presented after taking into consideration any known stock split occurrences in order to present the most directly comparable XOM historical dividend comparison possible. Below we examine the compound annual growth rate CAGR for short of an investment into Exxon Mobil shares starting with a 10000 purchase of XOM presented on a split-history-adjusted basis factoring in the complete Exxon.

Weighing The Week Ahead What Is The Risk Reward Trade Off For Stocks Risk Reward Energy Prices Dow Jones Industrial Average

Mcdonald S Stock Certificate Stock Certificates Money Template Certificate

Assets Owned By Pepsico Money Management Dividend Value Investing Robinhood App

Exxon Mobil Named Top 25 Safe Dividend Stock Increasing Payments For Decades

The Monolith And The Markets World Johnson And Johnson Short Message Service

Xom Exxon Mobil Corp Dividend History Dividend Channel

Dgi For The Diy Q1 2020 Dividend Portfolio Update Seeking Alpha Dividend Retirement Portfolio Portfolio

Certificate Of Origin For A Vehicle Template Luxury Bunch Ideas For Certificate Origi Excel Calendar Template Personal Mission Statement Examples Hire Purchase

Certificate Of Origin For A Vehicle Template Luxury Bunch Ideas For Certificate Origi Excel Calendar Template Personal Mission Statement Examples Hire Purchase

Dividend Portfolio My Financial Shape Investing Investment Portfolio Stock Portfolio

Exxon Mobil Corporation Nyse Xom May Shield Investors From Energy Prices And Provide A Solid A 5 8 Dividend Yield

Dividend Aristocrats With High Expected Eps Growth Dividend Dividend Investing Dividend Stocks

Exxon Mobil A Valuentum Style Stock With A Hefty Dividend Yield Nyse Xom Seeking Alpha

Exxon Mobil Stock Is One Of The Worst To Own In August

Will Exxonmobil Raise Its Dividend In 2019 Nasdaq

Exxon Mobil Committed To Dividend Shares A Buy Nyse Xom Seeking Alpha

Better Dividend Stock Exxonmobil Vs Clearway Energy The Motley Fool

Dividends Buybacks And Profits Growth What More Could Exxon Investors Ask For

Exxon Mobil Stock Who Wins When Fundamentals Chart Clash Nyse Xom Seeking Alpha