Fed rate hike

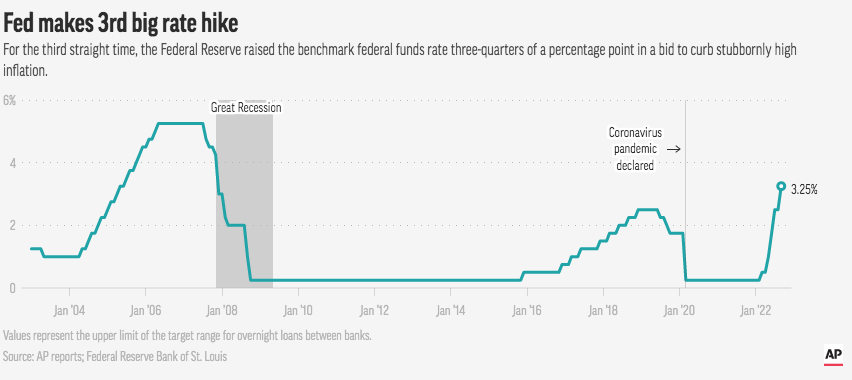

The Federal Reserve raised interest rates by another 075 percentage points Wednesday as part of its ongoing effort to fight inflation. The rate-making Federal Open Market Committee hiked the benchmark interest rate by 075 percentage points at the end of a two-day meeting.

Fed Raises Interest Rate Half A Percentage Point Largest Increase Since 2000 The New York Times

Published Wed Nov 2 2022 200 PM EDT Updated Wed Nov 2 2022.

. More specifically this refers to the rate at. For borrowers and consumers the fed rate hike means that many types of financing will cost more due to higher interest rates. Adjustable-rate loans such as ARMs that are no.

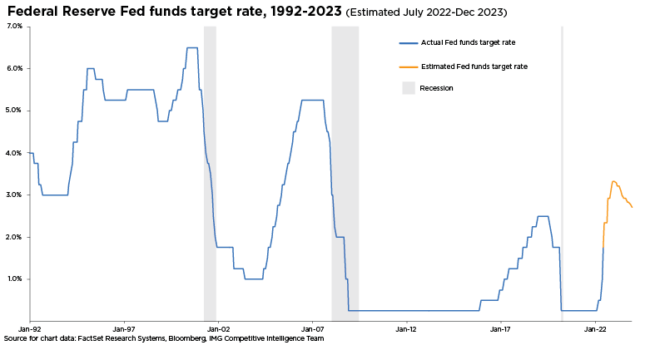

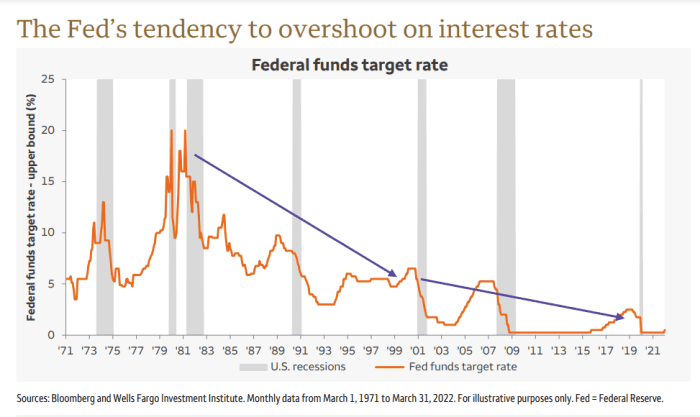

The Feds target policy rate is now at its highest level since 2008 - and new projections show it rising to the 425-450 range by the end of this year and ending 2023 at. The Federal Reserve will raise interest rates as high as 46 in 2023 before the central bank stops its fight against soaring inflation according to its median forecast released. Rate hikes are associated with the peak of the economic cycle.

This type of rate hike occurs when the US. That means the 075 percentage-point hike on Wednesday will add an extra 75 of interest for every 10000 in debt. So far the Feds five hikes in 2022 have increased rates by a.

Stocks Fall After Fed Hikes Interest Rates 075 Percentage Point. The latest increase moved the. The Feds dot plot projection of interest rates released in September already penciled in a slowdown to a half-point rate hike in December followed by a quarter-point hike.

Fed Meeting Today Live. Fed approves 075-point hike to take rates to highest since 2008 and hints at change in policy ahead. The Federal Reserve raised interest rates 75 basis points on Wednesday bringing its federal funds rate target to a range of 375 to 4.

Central bank raises the interest rate that banks charge each other. That implies a quarter-point rate rise next year but. The Wall Street Journals full markets coverage.

At the Feds Sept. A Fed Hike is an increase in the main policy rate of the US central bank called the US Federal Funds Target Rate. 20-21 meeting the median estimate among policymakers pegged the peak fed funds rate next year at between 450 and 475.

What rate hikes cost you. Rate futures markets now imply. What Is a Fed Rate Hike.

The Federal Reserve will raise interest rates just one more time in November before it stops due to a soaring US dollar according to market veteran Ed Yardeni. That point of view. The Federal Reserve delivered its latest monetary policy announcement with the central bank hiking rates by 75 basis points or 075 percentage point.

Pricing of futures tied to the Feds policy rate implied a 92 chance that the Fed will raise its policy rate now at 3-325 to a 375-4 range when it meets Nov. Nov 2 2022 at 318 pm ET. During his post-meeting conference Fed Chair Jerome Powell.

The Federal Reserve announced it was raising its key rate by another 075 percentage points lifting the target range to between 3 and 325. Fed officials signaled the intention of continuing to hike until the funds level hits a terminal rate or end point of 46 in 2023. The latest hike moved the Feds target funds rate range to between 375 and 4 the highest since 2008.

The big question is what happens next. The Feds actions will increase the rate that banks charge each other for overnight borrowing to a range of between 225 to 250 the highest since December 2018. Every 025 percentage-point increase in the Feds benchmark interest rate translates to an extra 25 a year in interest on 10000 in debt.

The Federal Reserve on Wednesday enacted its second consecutive 075 percentage point interest rate increase as it seeks to tamp down runaway inflation without.

Fed Hikes Interest Rates By Three Quarters Of A Percentage Point In Boldest Move Since 1994 Cnn Business

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/24042678/UzzuD_the_fed_has_been_raising_interest_rates_for_months.png)

The Fed Raised Interest Rates Again What Does That Mean For The Economy And Inflation Vox

With Inflation Offsides The Fed Keeps Hiking Charles Schwab

Bitcoin Price Hits 20 8k As Volatility Ensues Over Fed 75 Point Rate Hike

Will Steep Interest Rate Hikes Cause A Recession Nationwide Financial

Don T Worry Too Much About A Fed Interest Rate Hike Fivethirtyeight

Fed Attacks Inflation With Another Big Hike And Expects More Fort Worth Inc

The Fed Raises Interest Rates By 0 75 Percentage Points To Tackle Inflation The New York Times

Markets Brief There S Good News In Fed Rate Hikes Morningstar

Fed Raises Interest Rates Keeps Forecast For 3 Hikes In 2018

How High Can The Fed Hike Interest Rates Before A Recession Hits This Chart Suggests A Low Threshold Marketwatch

Treasury Two Year Yields Head For 4 Ahead Of Big Fed Rate Hike

Rate Hikes The Fed Won T Hike Nearly As Much As Expected Real Investment Advice Commentaries Advisor Perspectives

Federal Reserve Hikes Rates By Half Point To Tame Inflation

:max_bytes(150000):strip_icc()/fredgraph-a800d4ef93634168b10b23290a1a57d1.png)

Federal Reserve Interest Rate Hikes In Investors Crosshairs

Investors Expect A Faster Pace For Fed Rate Hikes Cnbc Survey Shows

Us Federal Reserve With The Third Interest Rate Hike This Year

Fed Cuts Us Interest Rates To Zero As Part Of Sweeping Crisis Measures Financial Times