tn franchise and excise tax return

Select Tennessee SMLLC Franchise Excise Tax Return from the left navigation menu. The franchise tax is a privilege tax imposed on entities for the privilege of doing business in Tennessee.

Tennessee Cpa Journal May June 2015

The minimum tax is 100.

. A SMLLC is required to file a franchise excise tax return when 1 it is not disregarded for federal income tax purposes or 2 when it is disregarded for federal income. Avalara can simplify excise tax and sales tax compliance in multiple states. This blog series will cover certain aspects of Tennessees Franchise and Excise tax and give particular focus to the more common exemptions available under the taxing statute.

The minimum franchise tax of 100 is payable if you are incorporated domesticated qualified or otherwise. The franchise tax on a final return is computed using either the book value of assets or net worth immediately preceding. Form IE - Intangible Expense Disclosure.

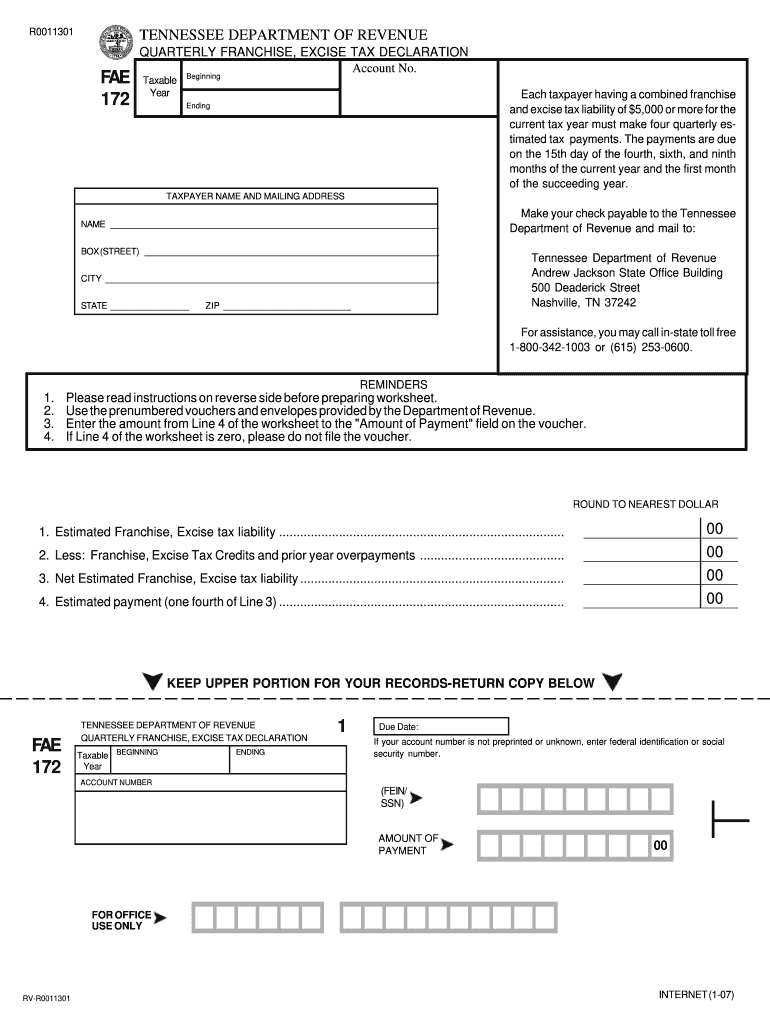

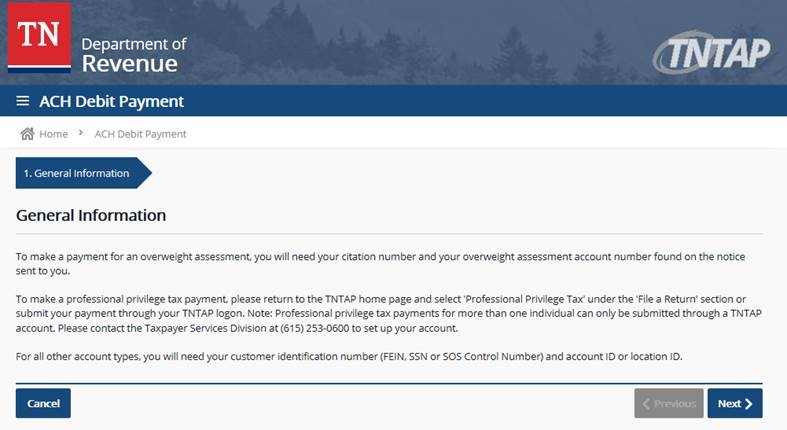

Penalty on estimated franchise and excise tax payments is calculated at a rate of 2 per month or portion thereof that an. Select the applicable Form CtrlT from dropdown menu. FE-9 - Extension for Filing the Franchise and Excise Tax Return.

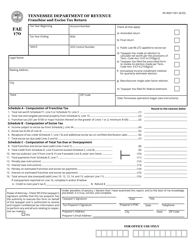

The minimum tax is 100. Franchise tax 025 of the greater of net worth or real and tangible property in Tennessee. Schedule 170NC 170SF Consolidated Net.

Schedule E rental Schedule. What is TN excise tax. We last updated the Franchise and Excise Tax Return Kit in February 2022 so this is the latest version of Form FAE-170 fully updated for tax year 2021.

All entities doing business in Tennessee and having a substantial nexus in. Ad Use Avalara to automatically determine excise tax rates for a variety of energy products. Franchise and Excise Tax Return Tax Year Beginning Account Number Tax Year Ending NAICS Legal Name Mailing Address City State ZIP Code a Amended return b Final.

You can download or print current or. Franchise tax 25 cents per 100 or major fraction thereof of the greater of either net worth or real and tangible property in Tennessee. Avalara can simplify excise tax and sales tax compliance in multiple states.

The following entity types may be required to file the franchise and excise tax return. A limited liability company must file a franchise and excise tax return even if it chooses to be ignored as an entity for federal tax purposes and is treated as an individual. Ad Use Avalara to automatically determine excise tax rates for a variety of energy products.

FE-15 - Inactive Business Final Return and Closing Your Account. Excise tax 65 of. Tennessee franchise and excise tax laws say that a SMLLC that is disregarded for federal income tax purposes will be disregarded for franchise and excise tax purposes if its.

Form FAE170 Franchise and Excise Tax Return includes Schedules A-H J K M N-P R-V. FT-2 - Franchise Tax Computation on a Final Return. Wwwtngovrevenue under Tax Resources.

Corporate Income or Excise. To receive a six month extension a taxpayer must have paid on or before the original due date an amount.

Fillable Online Tn Franchise And Excise Tax Job Tax Credit Business Plan Franchise And Excise Tax Job Tax Credit Business Plan Tn Fax Email Print Pdffiller

Permanent Tax Reforms Trump Sales Tax Holidays

Free Form Fae 170 Franchise And Excise Tax Return Kit Free Legal Forms Laws Com

Tennessee 2019 Form Fae 172 Fill Out Sign Online Dochub

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

Tn Dept Of Revenue Tndeptofrevenue Twitter

Tennessee Sales Tax Permit Application Startingyourbusiness Com

Form Fae170 Rv R0011001 Download Printable Pdf Or Fill Online Franchise And Excise Tax Return Tennessee Templateroller

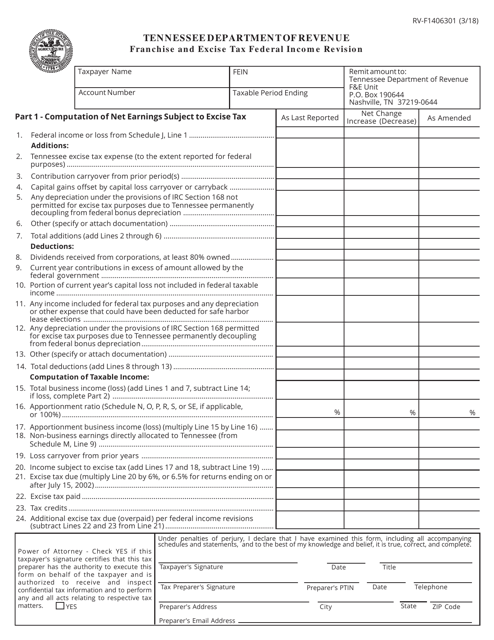

Form Rv F1406301 Download Printable Pdf Or Fill Online Franchise And Excise Tax Federal Income Revision Tennessee Templateroller

Incorporate In Tennessee Do Business The Right Way

Form Fae172 Download Printable Pdf Or Fill Online Quarterly Franchise Excise Tax Declaration Tennessee Templateroller

Tennessee Allows Annualized Method To Determine Excise Tax Estimated Payments Kraftcpas

S A L T Select Developments Tennessee Baker Donelson

Fill Free Fillable Forms State Of Tennessee

Tennessee Department Of Revenue Tntaptuesday News New Taxes Are Now Available To File And Pay On Tntap Motor Fuels Auto Rental Surcharge Bail Bonds Fantasy Sports Coin Operated Amusement Machine Local

Fillable Online State Tn Tennessee Tax Franchise Excise Federal Income Revision Form Fax Email Print Pdffiller

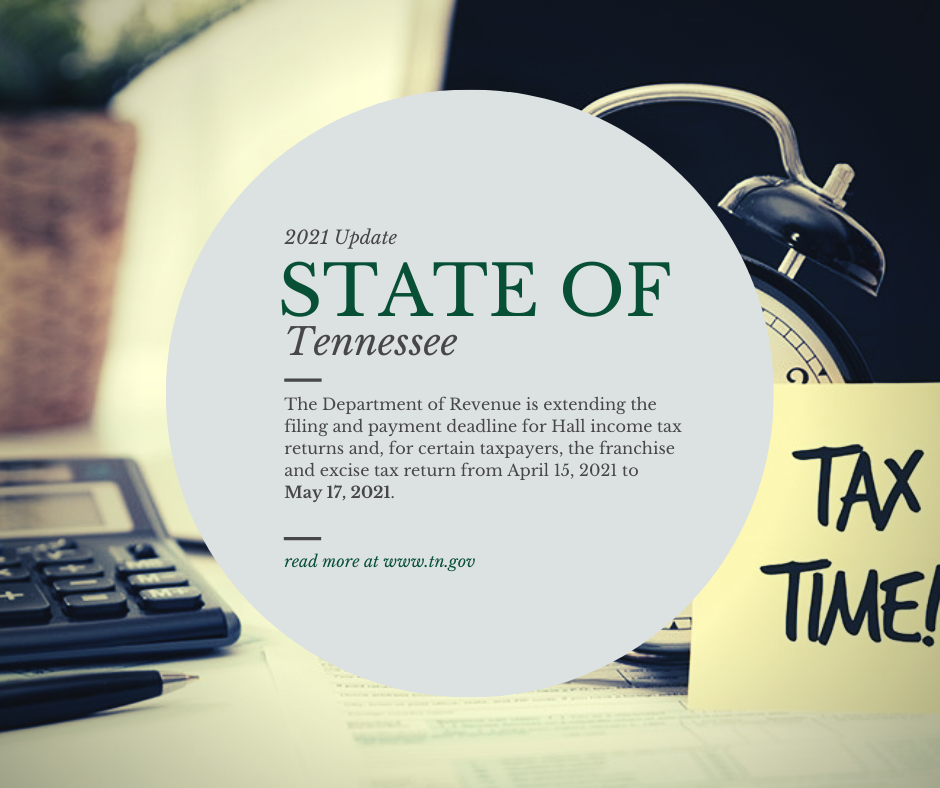

2021 State Of Tennessee Tax Deadline Extension Brown Brown And Associates Cpa Tax Services For Clarksville Nashville And Springfield Tn